There’s gold in them thar hills

January 23, 2024

When your client knows there’s more value than the numbers suggest.

Did you know that the phrase “there’s gold in them thar hills” was coined by Colonel Mulberry Sellars in Mark Twain’s novel The American Claimant in 1892. Apparently it was derived from a Georgia Assayer Dr Matthew Fleming Stevenson in an attempt to keep locals from heading to California for the Gold Rush in 1849.

There’s a message there for UK technology companies who think the grass is greener over the Pond and especially in California!

I am sure you have heard it from your clients. The investors simply do not understand the value in our business. This refrain can be heard from the FTSE 100 to the freshest start up in the UK.

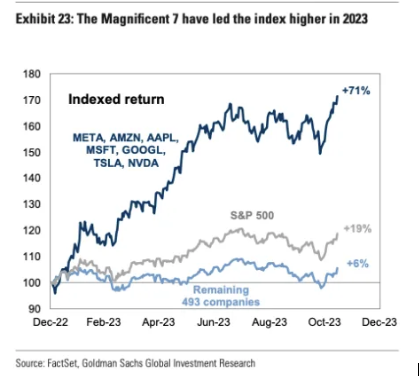

We happen to think the majority are right. We all know full well that that stocks listed on the UK market apparently achieve lower valuation multiples than those elsewhere and especially in the US (although the picture is more nuanced in reality – the US stock market rally last year was largely due to the Magnificent Seven, as per the chart I obtained from Yahoo Finance below. (One chart shows how the ‘Magnificent 7’ have dominated the stock market in 2023 (yahoo.com).

I would argue that the problem with the UK is not about the quality of our great companies, it’s about the challenge of helping investors to recognise that there is hidden value. Some investors have understood this, particularly the PE industry and overseas investors who take pleasure in buying companies.

Although this article is a bit out of date (July 2023) UK Public M&A Update – H1 2023 | Insights | Skadden, Arps, Slate, Meagher & Flom LLP, the message is clear. As the authors state: “The average share premium increased to 62.83% in H1 2023 (65.38% average share premium as compared to the three-month average share price prior to the commencement of the offer period 1), indicating that stakeholders believed that share prices in the United Kingdom undervalued publicly traded companies.

We mainly value unlisted companies, but the theme is similar. More needs to be done to help investors get visibility on hidden value in a company.

I am sure you have clients who bemoan the fact that their company’s value is not fully understood by investors with all the unpleasant knock-on effects around the cap table, the offer and more.

The lack of information on private companies does not help, but times are changing. Soon small companies will be required to publish a P&L alongside their balance sheet at Companies House, which will be good for transparency and data analytics, (but perhaps less good for competitive advantage!).

Even with a P&L and balance sheet the intangible value in a company will not be visible.

And there is typically so much intangible value which needs to be recognised and proved.

Amongst other valuation matters, we specialise in this critical area. The value of a management team, customer list, supplier relationships, know how, trade secrets, registered IP. And we always look to provide evidence to support our analysis.

Take the valuation of IP. We have data and solutions that identify what a patent’s market value is. We can use cashflow projections to understand how that value might grow.

For management teams, we have a deep understanding of how to compute the value of the core team e.g. what it would cost to replace them, how to understand the issue of the salary sacrifice (or not!) and what that means and more.

In one interesting valuation we conducted late last year, we identified a Duopoly Premium. Quite simply the lack of alternative targets available to the bidder and the costs and time it would have had to incur to build market share from scratch, justified that a premium should be paid which was significantly higher than the multiple-based valuation that had been put on the company.

One of the things we enjoy is trying (and succeeding) in finding academic research to support our arguments. It is not always possible, but it you would be surprised what business schools and their academic staff have researched over the years.

As you know, we do not consider valuations to be an art or a science. A valuation exercise is maths followed by explaining the arguments why the numerical calculation is missing something. Sometimes the missing piece is something that suggests the numbers have overestimated the value, but more often than not and thanks to the ingenuity, resilience and determination of the UK’s great business people, the missing piece is this intangible value. By articulating it clearly and simply, we can do our clients a very important service.

Perhaps you have a client who needs a valuation that can help them, their existing shareholders or even a potential acquiror properly to understand the value in their business? If so, why not give us a buzz? We would be delighted to help.

And of course, where there is a complex situation such as growth share valuations, just like all the other valuation work we do, we ensure that the valuation is accurate, evidence-based and understandable.