Big fake valuations

October 8, 2024

Not my claim but a statement from CB Insights in the US.

Last week I received an email with this subject line. It certainly made me open the email.

It came from CB Insights which has been growing like a weed selling data and insights on primarily US private companies. The weekly emails from Anand the CoFounder and CEO are always worth a read, not least because of the writing style.

On 3rd October Anand said:

“Hi there

1/3 of all unicorns have a valuation right at the $1B mark (or close).

85% of these are fake unicorns…

…who will never realize that valuation.

These are companies that chased the $1 billion valuation mark cuz it was:

- A status symbol

- Viewed as a way to recruit great talent

- Easy to get

But the fundamentals of these businesses never made them worth $1B.

Lots of distressed and 🔥 sales about to come to market.

Financial sponsors must be lickin’ their lips for the bargains to be had.

See the full list of unicorns here if you want to identify who is in the 85%.”

It is a list you should definitely read. It has over 1,250 unicorns on it as defined by the valuations at which they have raised funding from VCs et al.

My favourite fun fact from the list is around 1,000 have joined this club since the beginning of 2020.

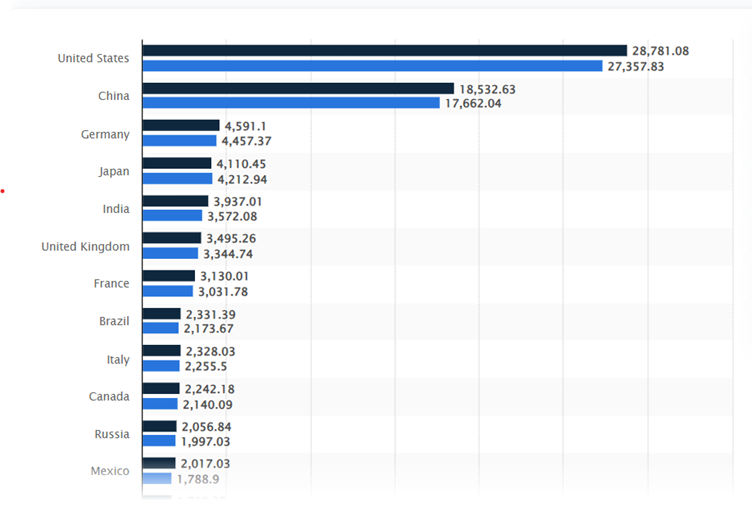

How does the UK compare?

The UK cohort is interesting. CB Insights uncovered 53 unicorns of which around 30 are in financial services or insurance or serving those businesses with enterprise technology. Is that telling about the balance of business in the UK – possibly?

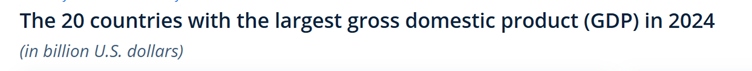

We are the 6th largest economy in the world.

Source: Statista

This is how we compare in terms of value of unicorns as a % of GDP

So in global terms the UK isn’t doing too badly as a percentage of GDP. Wouldn’t it be great it we could add another 50% to that percentage so we matched the US? That’s only another 26 unicorns @ $3.3bn each! Surely that is possible?!

At Athla we value companies ranging in in equity value from £nominal to £100ms. Quite literally no job is too big or too small.

Whilst employee incentives are often an entry point for a valuation exercise, it is becoming increasingly common for our valuations to become part of wider strategic discussions.

If you have a client who need a comprehensive, fully argued valuation that will stand up to scrutiny, do get in touch. We would be delighted to help.