Picks and shovels and data centres

June 10, 2025

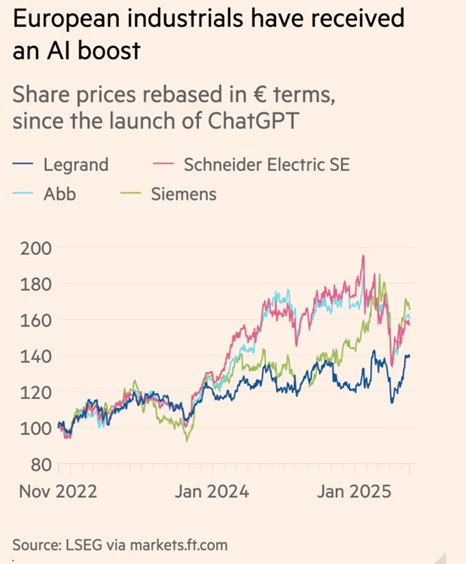

AI boom adds €150bn to value of four of Europe’s oldest industrial groups

Don’t you just love it when two things juxtapose to reveal a new example of an old truth?

I thought this when I read this article in the FT the other day. https://on.ft.com/4jECJPY.

Isn’t it delicious that whilst loads and loads of people are fretting about, engaging with or creating AI, that some good old real-world businesses are seeing a valuation boom. The ones I am talking about are of course electrical equipment makers such as ABB and Legrand who are deep into building and operating data centres where all those computers need to sit and whirr day and night.

The boom is also coming to switch and smart meter manufacturers. Identifying where the value is hidden (in plain sight?!) is all about the old rule of business – back the producer and or seller of the picks and shovels; not the gold mine or even the gold miner.

Tying yourself as a business to the “Next Big Thing” means your value will be more influenced by how it is behaving. All the companies in the FT article are finding their share prices to be more volatile for this reason, even though what they do is just what they did before – manufacturing useful bits of kit.

This scenario definitely got me thinking about how we value private companies being influenced by AI in a not immediately obvious way. Those on the ground are saying that volatility caused by being tied to the boom and busts in AI is understood and being managed, but if we were doing an external valuation where the factor was present, I think we would be using an average closing price over a longish period for the comparable quoted company analysis to iron out that “vol” – or we would impair the valuation for the risk of volatility. It would depend on the circumstances.

Depending on where the business we were valuing sits in the supply chain would also be critical to understand. And exactly what it does. Schneider Electric’s products range from software to monitor data centre infrastructure and racks to store servers and on to cooling systems to prevent high-powered processing facilities from overheating.

If our company was doing something more limited we may have to do more subtle adjustments to reflect the relative difference in risk and opportunity. It is all good stuff and keeps are grey cells burning.

I wonder how Messrs Schneider, Siemens and Legrand would have been able envisage where their businesses would be 150 years later? I am not sure if would have been possible to prepare a DCF to capture the 21st century AI boom?!

If you have a client old school or not that needs to understand how to articulate its present value and indeed the present value of the future, we would love to help.