Is inflation going to rear its ugly head again?

October 21, 2025

And, if so, what this means for valuations of companies, shares and other assets.

It’s been pretty busy here at Athla Valuations as we try to get as many valuations finished as possible before the Budget. We are all now pretty clear that Rachel Reeves intends to raise taxes in the Budget and if she does hit “those with the broadest shoulders” founders and families alike are going to need to be more on top of the valuations issue than ever before.

Already we are seeing confusion around tax on exercised EMI options. (More about that next week from our resident EMI expert Jack).

However, I thought this week I would send you an email with useful chat which will help you and your clients to understand why the gnarly issue of growing inflation is not just a topic for discussion around the price of butter.

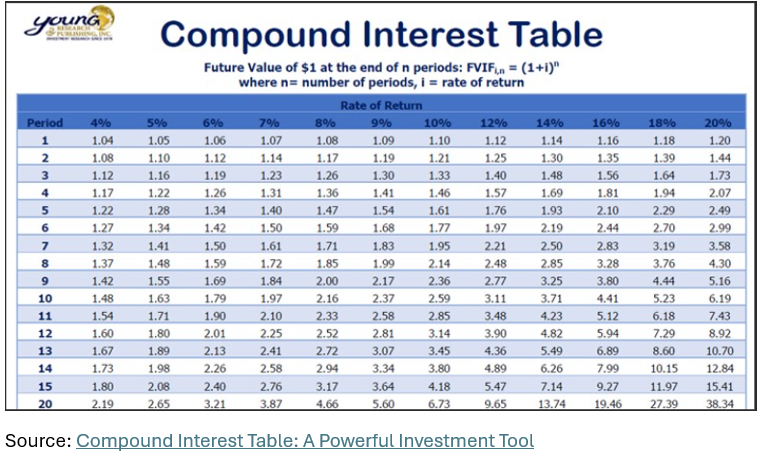

Thank you to Young Research for producing the table I have included at the top of this email (download picture if it is not visible). With inflation at 4% it will take over 15 years for the purchasing power of a $1 (or £1) to halve. At 6%, it would take just over 11 years and at 10%, just over 7 years, but its only just over 11 years at 6% and just over 7 years at 10%.

Why did I want to raise this with you as the smart adviser to your clients?

Well, the first thing is that if you are setting a preference share yield, do make sure you use the right % that will work for the shareholders who own the class. Set it too low and the value of the capital will erode over time, as the shareholders will not have been adequately compensated for the fact that they will only get the face value of the preference share in a return of capital. Set it too high and it will not be affordable in lean years.

Since the Bank of England became independent, the inflation rate has been much lower than historical peaks and troughs. It has a target 2% inflation rate. So a comfortable premium over that might be a good starting point. But do use the table above to understand what is going on. Inflation erodes capital values. So at 2% the value of a preference share will have halved in 20 years

Think about it this way. If the yield on a preference share is 2%, then over 20 years the total return (capital value plus the income) will roughly maintain its original value in nominal terms, but after allowing for inflation, the shareholders will not have had any real return on their capital. If you set the yield at 4%, the shareholders will get an effective real return of 2% a year and their capital will be protected. But even then, will a 2% annual income be sufficient to meet costs when inflation is at 4%?

Where else should you be thinking about inflation in the context of shares?

Here are a few examples

- Put and call options – consider including an inflation adjustment clause if you want to have set price for a put or call option around a share class.

- Options exercise prices – we tend to assume that the inflation in the economy, industry or company will mean that the uplift in the valuation of the company will correlate to the exercise price set potentially many years before hand. However, bear in mind that between option issuance many things can happen to the value of the company. It may be worth discussing this with your clients when they are setting up management incentive plans to see if the exercise price will actually be correlated to real exit valuation in the future (which itself has been subject to inflation). This will be especially relevant if the option scheme has a hurdle in it.

- Deferred consideration arrangements should take inflationary risk into account, especially if the deferred payments will be over a long period

If you have any questions on this topic or indeed a client whom you think would like to work with a valuer to cares about this type of issue, do give us a call or email us anytime.

PS We are hunting for a suitably qualified lawyer in Data Protection law to advise us. It is part of our ISO27001 requirements. If you know what we are talking about, please get in touch.