Could the value of a food brand be falling?

October 23, 2024

We don’t actually think so… yet…

We are all awaiting to see what HM Government will do regarding food brands that are increasingly being seen as “unhealthy”, either because of their nutritional content and/or their use of ultra processed foods, and whether this will impact on their value as a business.

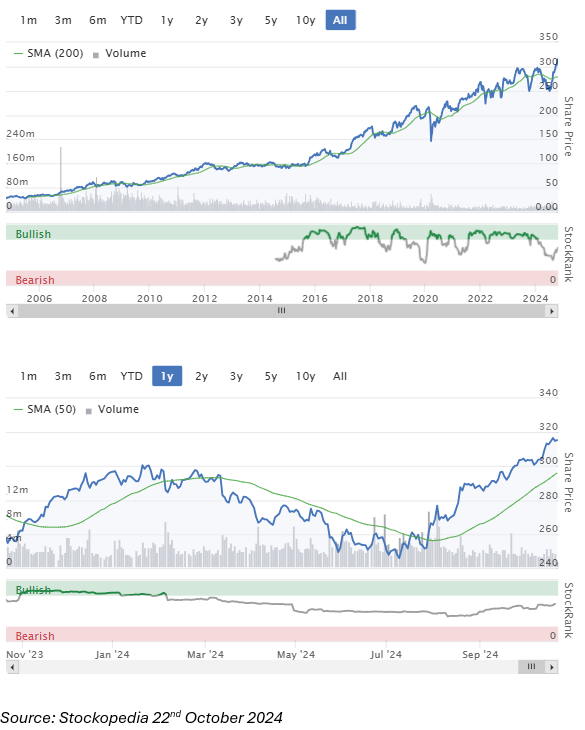

However, just to keep the debate balanced this is the share price of MacDonald’s over all time and then secondly over the last year.

I am not sure we should be panicking yet!

That being said, having a food brand does not guarantee that the value cannot be displaced by another upstart independent brand or by a supermarket label.

In my travels around the internet, I came across this article: Why private label brands are getting stronger The subtitle is “Private Label Grows Again, why brands should be worried.”

As the article says:

“The private label segment has the highest market penetration in Europe, followed by North America” according to Statista. The same source says that private label goods make up 21%-52% of supermarket sales in Europe.

I remember at least 10 years ago, surprising the team at an exclusive private bank lunch at which I extolled the virtues of Lidl. Yet now it’s a valuable and cool brand in shopping terms.

We pay attention to these facts because establishing the intangible value in the brand can make a big difference to the value of a company or its shares. Obviously we look at metrics driven from data sets such as the Forbes most valuable brands: The World’s Most Valuable Brands List and at cashflow forecasts. But we also look at performance relative to other competing brands when necessary.

You can place a monetary value on a food brand.

If needs to be considered whether there are registered trademarks. a registered formula or process (which is registered in some other way design rights, patents or simply a trade secret behind a brand.

“Impossible Foods has a total of 475 patents globally, out of which 204 have been granted. Of these 475 patents, more than 86% patents are active. United States of America is where Impossible Foods has filed the maximum number of patents, followed by Australia and Japan. Parallelly, United States of America seems to be the main focused R&D centre and also is the origin country of Impossible Foods.” Impossible Foods Patents – Insights & Stats (Updated 2024) according to insights by GreyB.

So, if you can value the IP, you have got some way towards valuing the business.

“Investing in the web” has this interesting article about the growth in the valuation of Impossible Foods IPO: revenue, valuation & how to invest. I don’t know if we would believe the $10bn valuation cited but this article has lots of data points that we would use to inform a valuation.

It is possible to buy shares in Impossible Foods although it has not yet IPO’d. If you are keen this is a useful article. How to Buy Impossible Food Stock in 2024 | The Motley Fool. As valuers we would be looking closely at what prices are being achieved in grey markets like those operated by Forge Global.

So UK brands, however small, should be ambitious. There is a chance that they can protect their brand and make it more valuable or perhaps they could sell a similar formula under a private label for a supermarket which might make them some nice profits.

The company strategy will add value to the business.

We love looking at intangible value. Each case is so curious.

If you have a client with a company where the founders value the brand (even if that value is not immediately obvious to you or others), do get in touch. I am sure we will be about to pin it into £sd for them.