Follow the valuation – it will always chime with the truth!

June 24, 2025

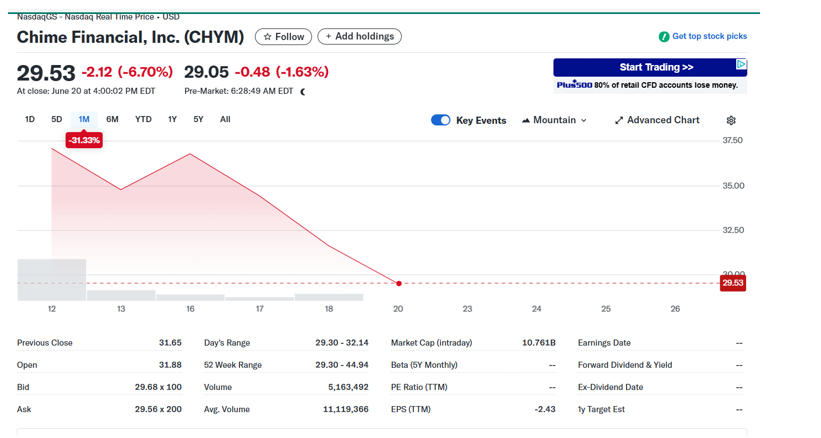

The case study of Chime in the US demonstrates how there is truth in valuations of private companies before they float.

I am not sure how many of you follow the US IPO market, but it is something we keep an eye on.

The recent Chime IPO is a lesson that liquid markets do reiterate the story that private market valuations tell. Or it is vice versa, that private markets pre-empt what listed markets will go on to tell you?

Chime’s shares only listed on the 12th of June, but already the price per share has fallen both below the IPO price (which is never good news) and the below the price being quoted in an article on Fortune.com published at the end of May: The Chime IPO: what would-be investors should know about its $31 a share private market valuation and more | Fortune.

We had not started our valuations business back in 2021 so weren’t following markets as closely as we are now. However, the Fortune.com article mentions that back then Chime was valued at $25bn (Series G $24.3bn: Crunchbase). Just prior to the IPO, it was trading on the private secondary market Forge at £31.50 a share, less than half of its 2021 valuation.

So the last four years have not been kind to Chime’s investors and it looks like the IPO may not have been ideally timed. The current geopolitical tensions and the resulting uncertainties in global capital markets may not have helped the latter. It is important to note that listed prices reflect the market’s sentiment at a given point in time and fluctuate due to macro events. Therefore, convergence of public and private valuations is not a one-off event but is an ongoing process via which the listed price gradually captures overall market sentiment.

This does not mean Chime’s investors have not made money at the IPO. Chime had raised over $2.3bn before it IPO’d, with the last fundraise being in August 2021. On the face of it, the investors in the F and G rounds will have lost money, but those investing in Series E and earlier will have made money. Apparently! Of course, the devil will be in the preference stack.

What lessons can valuers learn from this little story? Firstly, we need to pay close attention to the data provided by the myriad extant and emerging private secondary markets. There will be more of these in the UK soon, with the emergence of the PISCES framework – PISCES: platforms for trading private company shares | FCA.

We predict that valuations of private companies implied by private secondary markets will be closer to what they would be worth if they were to publicly list on an exchange. In other words, there will be no premium for listing on a stock market by default. This will challenge the common practice of discounting for the lack of liquidity.

We will have to find new ways to justify a small company commanding a lower multiple than its listed peers. Maybe it will be on size alone? We will be doing some research to see if there are any useful academic papers on this issue over the summer.

In the meantime, we are always up for both the simplest and most complicated valuation challenges. If you have anything on your desk, please do give us the opportunity to quote. We are always available on the numbers and emails listed below.