Minority Valuations – case law

May 16, 2023

One of the most common requests we get is to value minority shareholdings…

This can be triggered by an issue of share schemes (including options and growth shares) to incentivise staff, the buyout of passive shareholders in a business or when founders want to transfer some of their holding to another person.

The easiest way to assess such a holding is to value the company (adjusted for enhancements and impairments) and then consider the minority discount that should be applied.

Why the size of the minority holding matters when thinking about the discount.

Prima facie there needs to be consideration of whether a minority discount should be applied.

Consider a situation where there are only two shareholders both of whom run the business and have an equal say in all decisions.

In this scenario, applying a minority discount may not be suitable, especially if an orderly handover of shares from one to the other is required.

At the other extreme there may be someone with a super majority shareholding of over 75%.

As the super majority shareholding controls the business, the value of owning a few more % of the share capital does not make a big difference especially if drag along rights are in place as it means all the shares must be sold together if a 3rd party acquiror turns up.

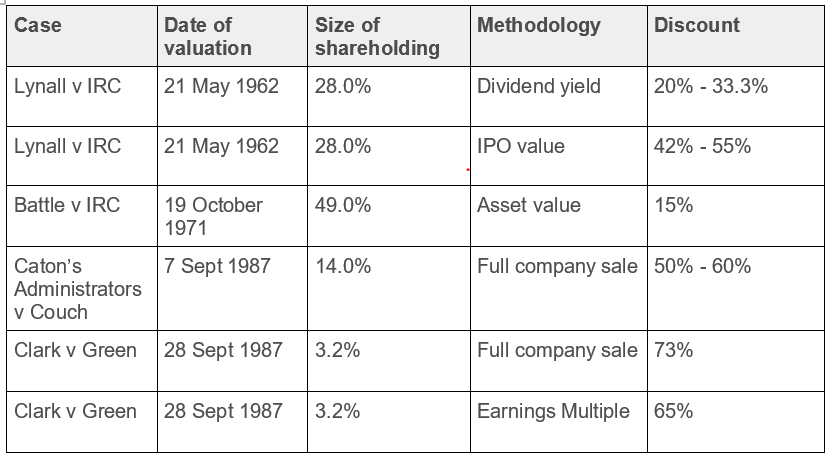

Take a look at the useful table below of case law:

It gives you a good idea of what discount could be applied to a minority holding. (It’s worth pointing out that these discounts may have included other reasons for impairment to value in addition to the minority discount specifically).

On the flipside, could a minority holding ever command a premium?

The answer is yes!

In a situation where the acquisition of a minority shareholding means the buyer of the shares will end up with a more influential stake or even control of the business, there is a good case for a premium to be paid.

A purchase of a minority that takes another shareholder over 25%, 50% or 75% could justify the buyer paying a premium.

A premium might also be payable if the acquisition of the shareholding gives the owner something extra, perhaps a board seat or enhanced voting rights for example.

Each situation is unique.

If one of your clients is reorganising its cap table whether through an issue of shares or from one or more shareholders buying out others, we would be very happy to help.