Sobering news on EBITDA multiples from the US

April 23, 2024

A fascinating report from BVR in the US gives insight into the changes in historical EBITDA multiples for many industries.

Business Valuation Resources, which acts as one of our insights into private company valuations (albeit the US), does exactly what it says on the tin.

It has just released its DealStats Value Index Digest ezine with the powerful heading:

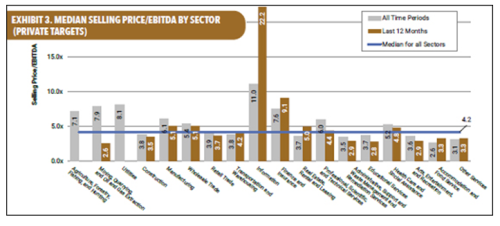

“ALL-TIME MEDIAN EBITDA MULTIPLE FOR ALL SECTORS IS 4.2X”

This chart summarises the findings by sector and I thought it would be very useful for you to have it to hand.

As the article says

“All-time EBITDA multiples remain the highest for the information sector (11.0x) and the utilities sector (8.1x). Meanwhile, the lowest all-time EBITDA multiples are in the accommodation and food services (2.6x) and the other services sectors (3.1x). The median across all industry sectors for all time periods is 4.2x. The information sector has shown a notable recent increase, with the last 12-month EBITDA multiple rising to 22.2x when compared with its all-time period multiple of 11.0x.”

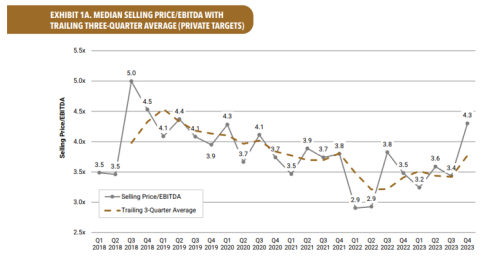

This chart is also useful background.

It shows why using “VC” fundraising EBITDA multiples may not be the right thing to do when valuing private companies outside a fundraise.

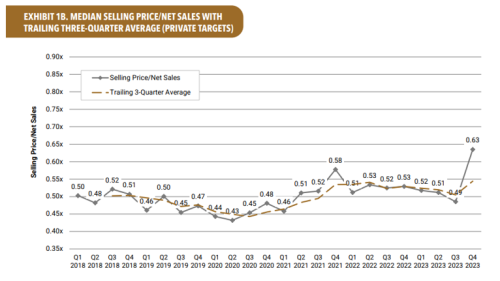

Likewise sales multiples are a lot less exciting when you take a whole market average.

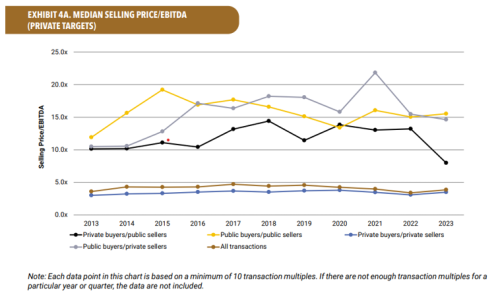

And this chart exemplifies the difference in investors’ perceptions of value for public equity values vs private equity.

Maybe there really is a premium for being listed, that private company M&A cannot command, although the devil is always in the detail.

Do call us if you would like to discuss what these charts mean, but the main message for clients is to explain to them that the value placed on an investment by a high-risk appetite (VC)/speculative investor backing a company with new capital to achieve extraordinary growth, is definitely not the same as the market price a hard nosed acquiror may be willing to pay.

We always look at the valuations we produce in the context of what an acquiror would be most likely to pay. I often explain that most of the latter will pay 3-8x EBITDA not least because they need payback on the acquisition.

It’s comforting to see that this data conforms with this view in the round!

We are always happy to work on valuations in many different use cases. Whether its helping a client to understand whether an offer of VC/angel investment is at the right valuation or not, to getting valuations for share option scheme and similar right for HMRC (and the option recipients!) to valuations for probate, divorce and corporate reorganisations and even to understand whether the offer to acquire the company is fair, each case is unique. That is what makes valuing companies, assets and shares so interesting. However there are always boundaries and context is all.

The thing always to be aware of is the valuation must be justifiable and all data and arguments used must be backed with evidence (saving only very occasionally when there simply is no evidence available, when we rely on our expert opinion).