A quick read…

June 20, 2023

Recommended reading about Valuations of VC-backed transactions

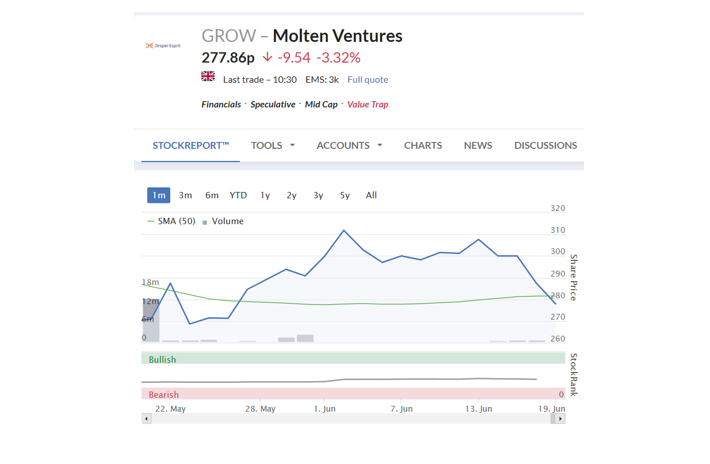

I noticed Molten Ventures PLC announced its results last week…

This is a good case study illustrating the valuations issues around VC-backed transactions.

Take a look at the impact on the company’s share price in the last month…

And also since the company listed…

These charts clearly demonstrate the valuations journey that VC has undergone in the last few years.

Molten is a top-grade VC investor and I’m confident that their portfolio will be very professionally managed year on year, so the issue is not the quality of the underlying companies, but more the impact of how changes in market conditions can move prices.

In summary: the pullback in availability of capital due to market uncertainty has meant that valuations have suffered. (You can read the full article here: Private co valuations ‘likely’ to stabilise soon, says Molten Ventures)

Like other VC portfolio companies many of Molten’s holdings will have had to adjust their business models accordingly to preserve cash.

And when there are few sources of new capital, buyers can price lean.

Overall the impact is that valuations drop.

Of course, many private companies are not in the VC space.

For large private companies and some smaller ones, it is often relevant to consider quoted comparable datasets.

We always look both in the UK and internationally for comparables. They can be very informative in setting the primary valuation before we consider the company specific factors that might lead to valuation adjustments.

For very small companies it is not always appropriate to use them, but instead to rely on private company comparables. M&A data is so important and we also use funding round valuations (adjusted of course), if appropriate.

We have been doing a lot of work for companies both in and not in receipt of VC/angel funding.

Each case is unique – whether the valuation is for the tax man or to resolve the transfer or issue of new shares, it’s equally important to take care and for the work we do to be relevant to the use case.